Tax Relief Opportunities

Potential Ways to Offset Your Tax Impact

You may be eligible for ways to offset increases to your property taxes, including:

Homestead credit refund – the state’s largest property tax refund program.

Special one-year refund – for excessive increases (12% increase and at least $100).

Senior tax deferral – helping those 65+ manage property tax bills.

Renters’ property tax credit – tax relief for renters.

The referendum may make you eligible for these refunds/credits or may increase the amount from any refunds/credits you already receive. In addition, an increase in property taxes may be deductible on your federal tax return if you itemize deductions.

What is the Homestead Credit Refund?

The Homestead Credit Refund program began in 1967 and today is received by over 500,000 Minnesota homeowners.

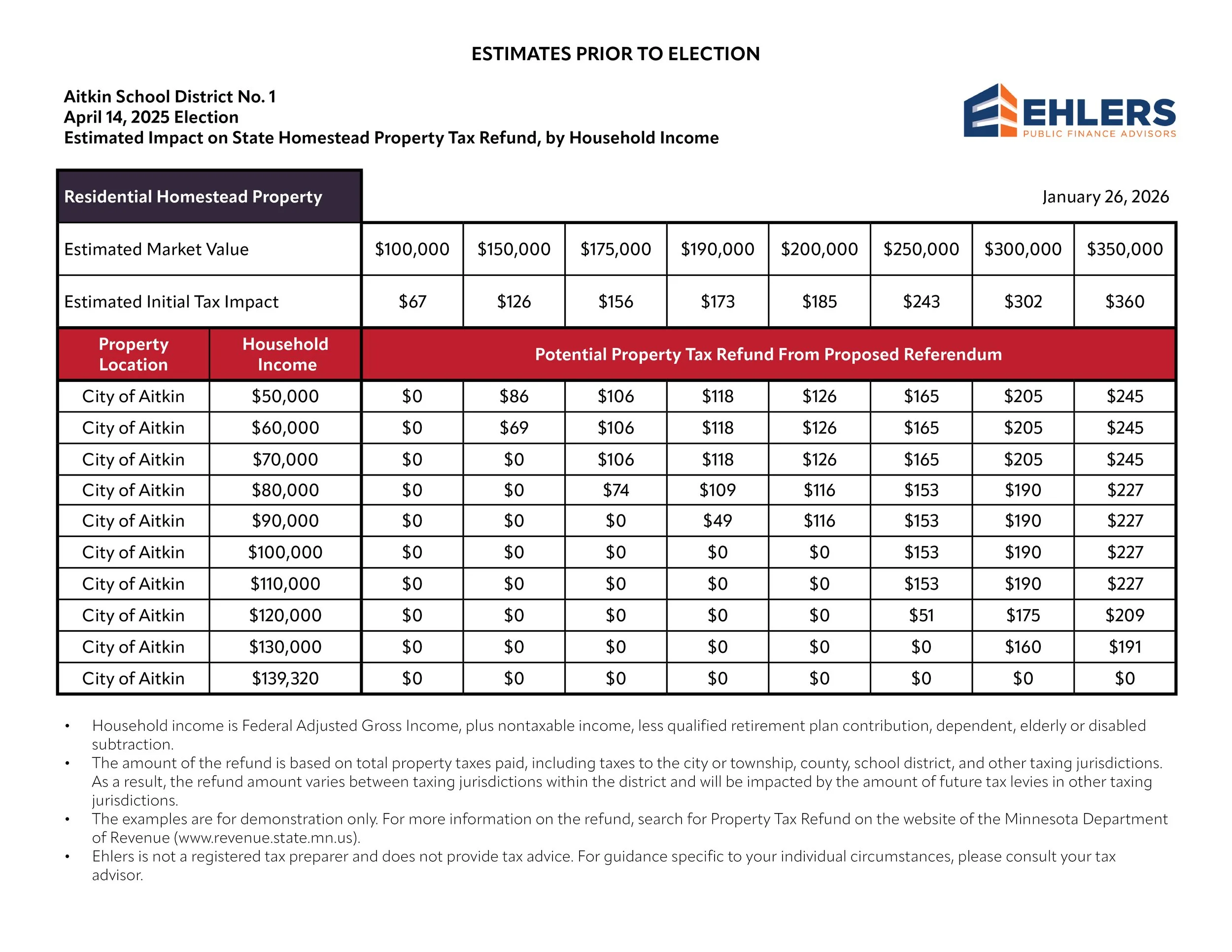

Homestead Credit Refunds are provided on a sliding scale and based on your household income and property tax bill. The refund increases as your property taxes increase, up to as much as $3,310 each year.

Excess property taxes: Refunds will range from 53% to 88% of the excess property tax you pay, as determined by a state formula based on income.

How do I know if I qualify for the Homestead Credit Refund?

Your total income is less than $139,320.

You are a Minnesota resident for at least half of the year.

You owned or occupied your home as of Jan. 2, 2025.

Your property is classified as your homestead.

You have no delinquent property taxes.

As many as 65% of homeowners statewide may be eligible for annual state property tax refunds if property taxes make up more than 1% to 2.5% of household income (a threshold that adjusts based on that income).

If eligible, you may apply for the Homestead Credit Refund by mailing in the paper M1PR form, or via the MN Department of Revenue website. Online applications generally open in May, and both paper and online forms are due by August 15. If you qualify, your refund will be received separately from your income tax return and will not appear on your property tax statement.

If you already received this refund from the state, it may increase if the referendum passes. While this won’t eliminate new taxes, it will help offset them.

If you qualify, but don’t currently receive a refund (an estimated 400,000 or more homeowners may qualify each year statewide, but haven’t requested the refund), your refund will apply to both your current tax bill and any increases from the referendum.

Examples of Tax Relief Opportunities

Everyone’s tax situation is different. The example to below is for demonstration only. To determine exactly how opportunities like the Homestead Credit Refund could impact you, please contact your tax professional.