Maximizing Value for Aitkin Taxpayers

Aitkin Public Schools has worked hard to ensure the proposed plan provides long-term value to students, staff, and taxpayers. Given the age and condition of Rippleside Elementary, taxpayer-supported investments are inevitable. The question isn’t whether our district invests in elementary education, but how we do it.

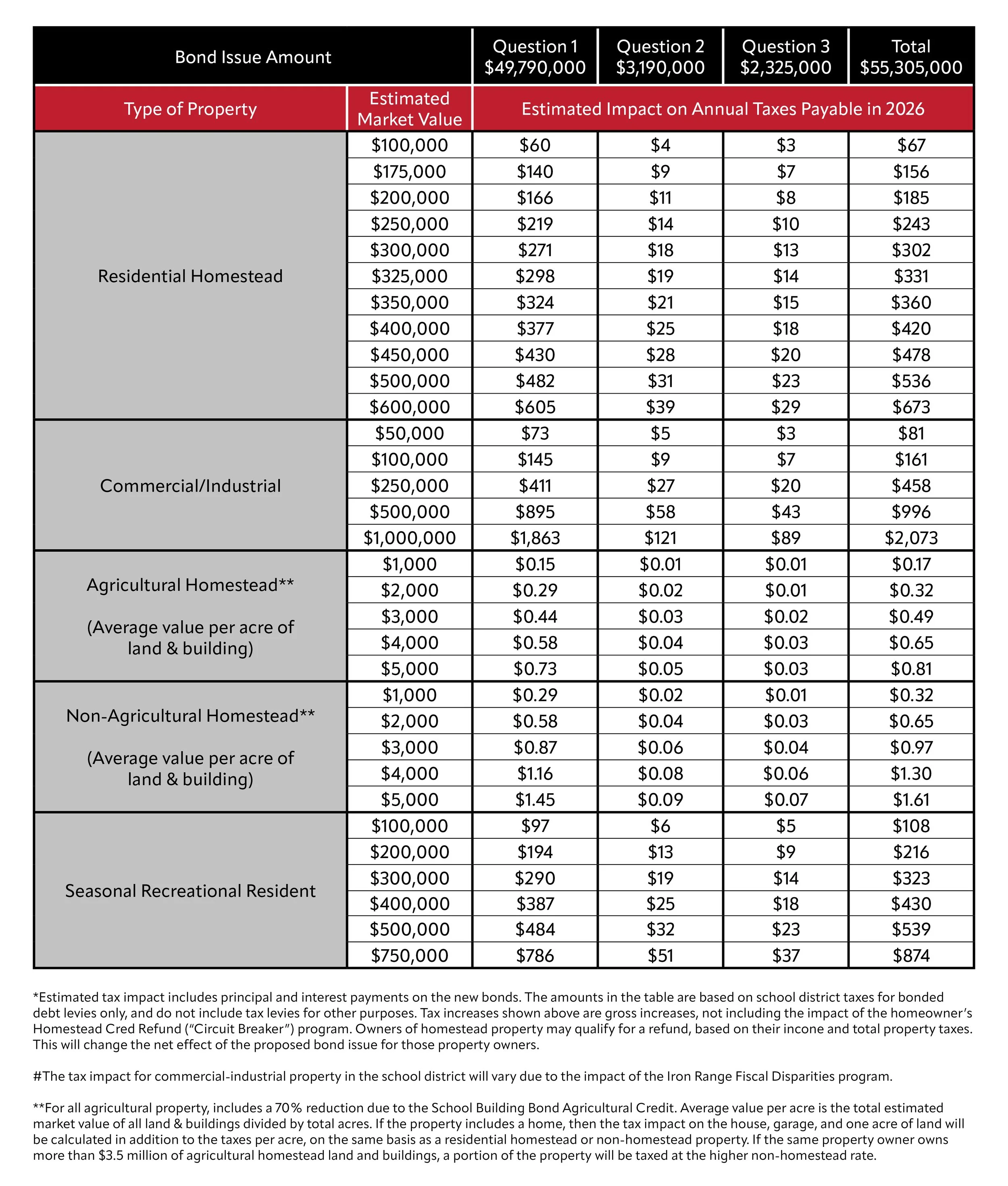

If approved by voters, the proposed plan will be supported by a tax increase on property within the school district starting in 2027. The tax impact for the new plan is approximately 33% lower than the plan proposed in November 2025. This was accomplished by reducing planned square footage for the new school building, gym, and bus storage.

Your individual tax impact will depend on the value of the property you own. For example:

Click on the image above to view larger.

Funding Sources

To minimize the impact on taxpayers as much as possible, Aitkin Public Schools is actively exploring other funding sources, such as state bonding and community partnerships.

TAX BASE BREAKDOWN

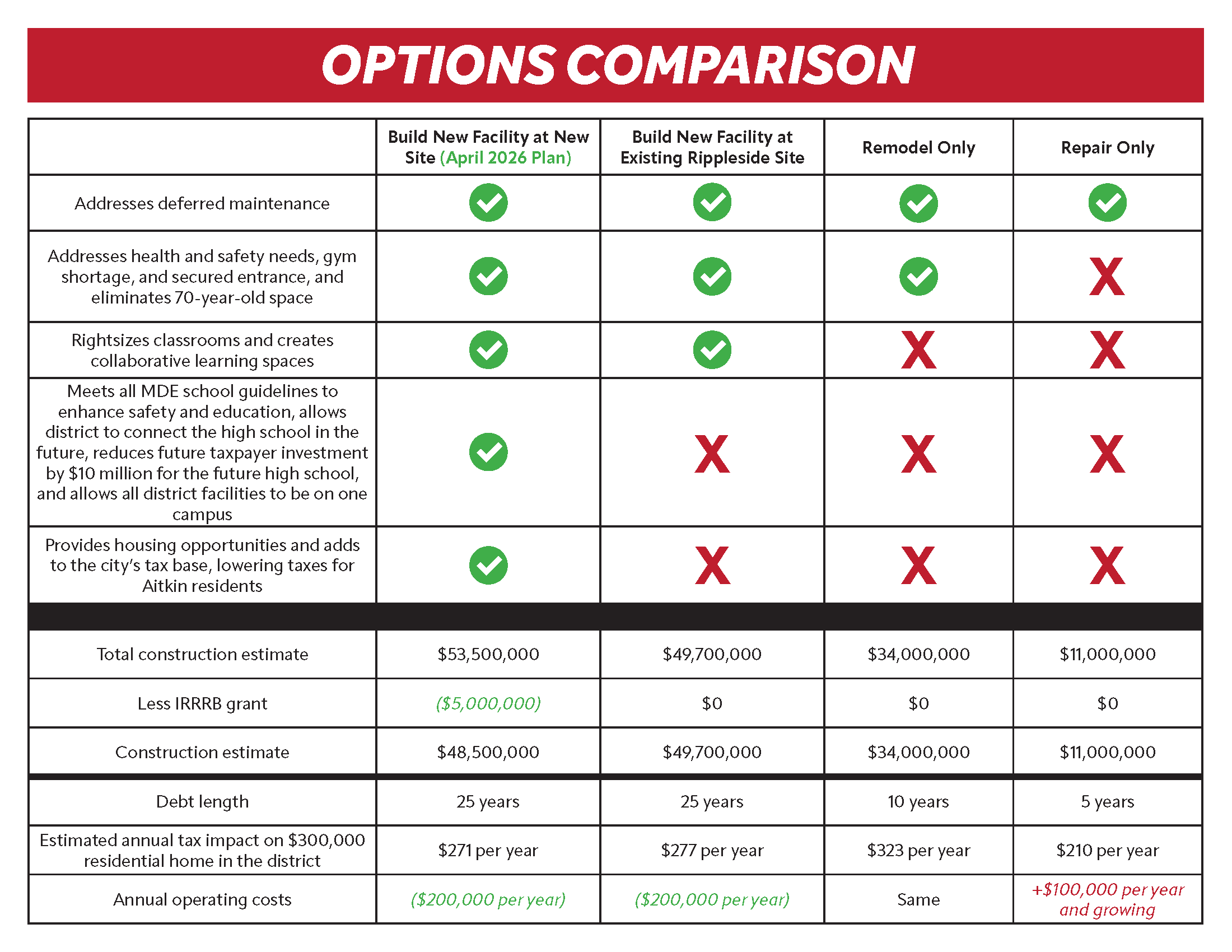

How does the cost of the plan compare to other options the district considered?

The district considered several options, ranging from basic completion of deferred maintenance to building a new school on a new site. Each option would require a tax increase, but only the proposed referendum plan would improve safety, meet all guidelines set by the Minnesota Department of Education, and avoid disrupting students during the construction period.

How does the cost of the plan compare to the November 2025 referendum?

The April 2026 referendum will cost the homeowners anywhere between 28-33% less than than the November 2025 plan, depending on the value of your home.

Click on the image above to view larger.

Will the district receive financial assistance from any other sources?

Yes. Ahead of the November 2025 referendum, the Iron Range Resources & Rehabilitation Board (IRRRB) agreed to grant Aitkin Schools $5 million to support a new elementary school building, contingent upon a successful referendum. The IRRRB has indicated their willingness to provide this grant again should the April 2025 referendum be approved, and members will formally consider reauthorizing the grant opportunity during their next meeting on Thursday, Feb. 12.

This grant and other, smaller sources of state aid are already factored into all tax impact projections.

Ag2School Tax Credit

To reduce the impact of a bond referendum on owners of farmland, Minnesota’s Ag2School Tax Credit offers a 70% tax credit to all agricultural property except the house, garage, and one acre surrounding the agricultural homestead. This is not a tax deduction – it is an automatic dollar-for-dollar credit, with no application required.

Through the Ag2School tax credit, the State of Minnesota will pay about 8% of the project, if approved by voters.

Please visit our connect page to submit questions or feedback.